Iron Condor Trading Bot

Trading Bot designed to schedule and execute SPX iron condor trades on Interactive Brokers

Problem Statement

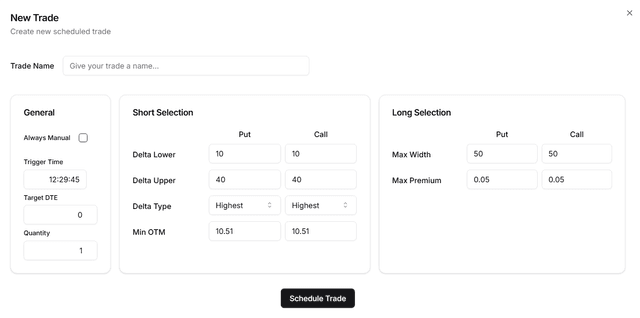

An options trader based in Dubai wanted an easy way to schedule and automatically trade iron condor strategy on the SPX. The trading system was required to trade on Interactive Brokers platform and allow for various user inputs related to expiration, strike selection, time of trade, quantity, etc.

Challenges

- Real-time data retrieval and greeks computation

- Quick order execution with low latency, especially considering it is an options strategy involving multiple legs

- User-friendly one-click local setup and deployment of the trading system

Solution

Summary

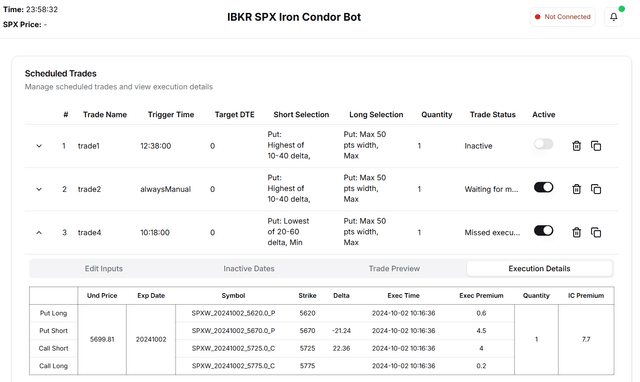

I developed a web application with features for easy scheduling, strategy customization and tracking of executed trades. The application was designed to connect to Interactive Brokers TWS platform and run locally without requiring deployment on an external server.

Key Features

- A robust backend built using python and Flask and designed to manage trade execution as per user inputs

- Intuitive UI designed for easy setup of trades and management of strategy inputs

- Real time monitoring of backend process status and live SPX prices

- Provision for one-click manual execution of multi-leg strategy

- Trade preview feature that can be used to simulate the outcome of a trade before execution

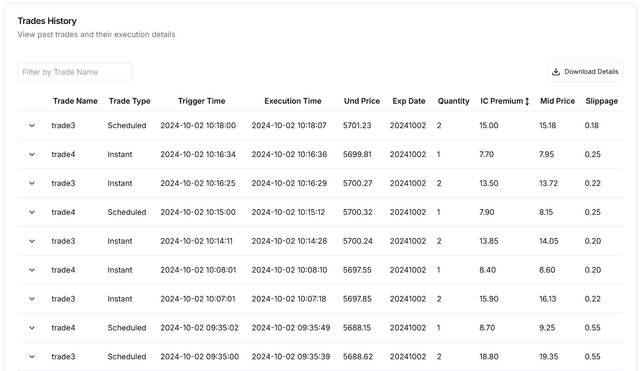

- Downloadable trades history logs that is useful for analysis and strategy optimization

- Option to toggle between paper trading and live trading

- Detailed user guide with step-by-step operation instructions for non-technical users

Technologies Used

- React/Nextjs with typescript and tailwindcss for frontend

- Python Flask backend

- Websockets for real-time data streaming

- Interactive Brokers ibapi

New Trade Inputs

Trade Scheduling and Monitoring

Downloadable Trades History

Have a similar challenge?

Let's discuss how we can develop solutions for your specific use case.